METTLER TOLEDO INTERNATIONAL INC/ (MTD)·Q4 2025 Earnings Summary

Mettler-Toledo Beats on Both Lines, Raises FY26 Guidance

February 6, 2026 · by Fintool AI Agent

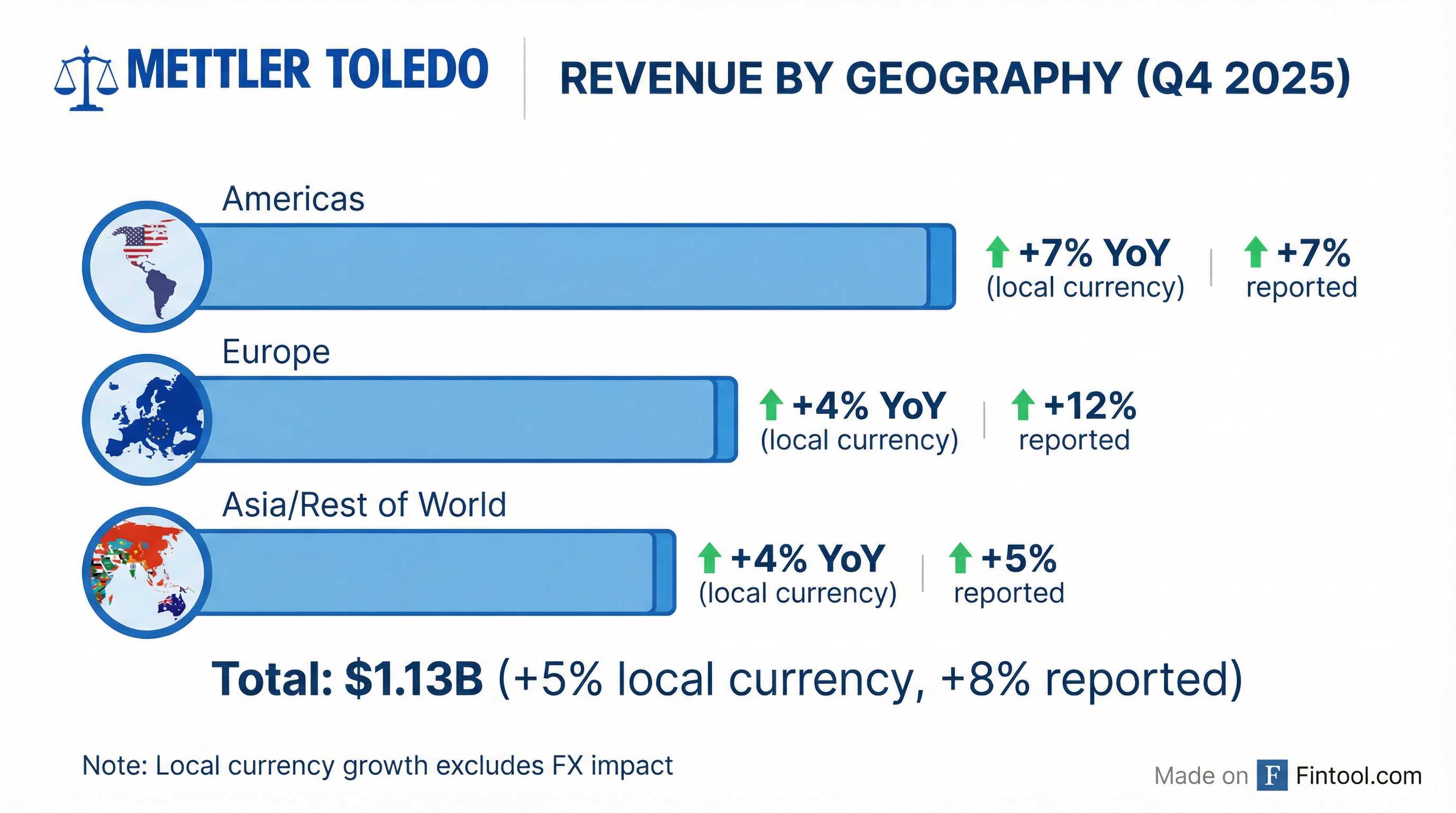

Mettler-Toledo International (NYSE: MTD) delivered a strong finish to fiscal 2025, beating both revenue and EPS estimates for the eighth consecutive quarter while raising full-year 2026 guidance. Q4 revenue of $1.13 billion (+8% YoY reported, +5% local currency) exceeded consensus of $1.10 billion, and Adjusted EPS of $13.36 surpassed expectations of $12.81 by 4.3%.

Did Mettler-Toledo Beat Earnings?

Yes—and this marks the eighth consecutive quarter of beating analyst estimates. MTD has beaten EPS estimates in 7 of the last 8 quarters, with an average surprise of ~4-5%.

Values retrieved from S&P Global and internet sources.

The beat was driven by broad-based growth across geographies and product categories. CEO Patrick Kaltenbach noted: "We had a great finish to the year with broad based growth by geography and product category. Our team continues to execute very well in a challenging environment."

What Did Management Guide?

Management raised FY2026 guidance, signaling confidence despite ongoing macro uncertainty:

The guidance raise of ~$0.70 at the midpoint (from $45.68 to $46.38) implies continued confidence in operational execution and margin expansion. The FY2026 guide of 8-9% EPS growth outpaces expected 4% local currency revenue growth, suggesting ongoing margin leverage.

What Changed From Last Quarter?

Key improvements:

-

Geographic acceleration — All three regions delivered local currency growth of 4%+ in Q4, compared to mixed results earlier in the year. Americas led at +7%.

-

Product Inspection standout — Grew 11% (7% organic), with particularly strong performance in Europe driven by mid-market innovation.

-

Service milestone — The service business reached $1 billion in annual sales for the first time, penetrating roughly one-third of the $3 billion serviceable installed base.

-

Bioprocessing strength — Strong growth especially in single-use consumables and process analytics in the Americas.

Continued headwinds:

-

Tariff impact — Gross tariff costs reduced Q4 operating profit by 7% and were a 190bps headwind to operating margin.

-

Gross margin pressure — Q4 gross margin of 59.8% was down 140bps YoY, including 70bps from unfavorable FX and 190bps from tariffs. Organic gross margin was only down 20bps.

-

Currency headwinds — FX was a 100bps headwind to Q4 operating margin and will be ~50bps headwind for FY2026.

Segment Performance & 2026 Outlook

Management provided detailed segment guidance on the earnings call:

Pricing outlook: 3.5% in Q1 (benefiting from mid-year 2025 pricing actions), 2.5% for the full year.

Organic volume: Down ~1.5% in Q1, up ~1% for the full year as management expects gradual improvement.

How Did the Stock React?

MTD stock was down ~0.5% in after-hours trading to $1,382.85.

Values retrieved from market data.

The muted reaction may reflect that the beat and guidance raise were largely priced in—MTD has rallied ~46% from its 52-week low and trades near the high end of its range. Analyst consensus maintains a "Hold" rating with an average price target of ~$1,442.

Full Year 2025 Results

For the full year, Mettler-Toledo delivered solid results despite macro headwinds:

Excluding acquisitions and timing impacts from delayed Q4 2023 shipments, FY2025 local currency sales grew 4% with balanced geographic contribution.

Regional Performance

Q4 2025 Geographic Breakdown:

Americas: Strong bioprocessing growth, especially in single-use consumables. Product inspection and retail also performed well.

Europe: Exceeded expectations driven by exceptional Product Inspection performance. The Spinnaker go-to-market program and direct sales model continue to drive market share gains despite PMI in the low 40s.

China: Industrial had strong growth against easier comps, pharmaceutical end market doing better. Chemical sector remains more challenging. Management noted "you could just feel that there was a lot more positive energy coming out of our industrial team" during the September budget tour.

Capital Allocation

Mettler-Toledo continues to prioritize shareholder returns through buybacks:

The company repurchased ~3.8% of shares outstanding in FY2025, continuing its multi-year track record of reducing share count. Total long-term debt stands at $2.09B with net debt of ~$2.0B.

Q&A Highlights

Key themes from the analyst Q&A:

Customer Cautiousness: Management expects customers to start 2026 more cautiously due to lingering uncertainty, despite improving headlines in pharma/life sciences. "While headlines have been better on the pharma and life sciences side... there's still more uncertainty in the market out there... leading to longer deal cycles." — Patrick Kaltenbach

Reshoring Timeline: On-shoring/reshoring investments are viewed as a 2027+ opportunity, not a 2026 growth driver. "These factories still have to be built, right? And then we come into play with our portfolios to build it out. So we see it as more as a 2027 and beyond opportunity." — Patrick Kaltenbach

China Pharmacopoeia: New regulations requiring stricter minimum weighing standards are supporting gradual lab upgrades, though not a step-change. "It's supporting our ongoing growth in China and the lab business in 2026, but it's not a huge step change that comes all at once." — Patrick Kaltenbach

Replacement Cycle: The installed base is aging after ~2 years of subdued replacement demand. Management expects gradual pickup once market conditions stabilize: "We see a little bit of aging of installed base... once the market gets a bit more stable, we will see a gradual pickup again." — Patrick Kaltenbach

Swiss Tariffs: The reduction from 39% to 15% will benefit 2026 results, adding ~1% to EPS.

Product Innovation

Recent launches highlighted on the call:

- Vero Electronic Pipette — Lightweight design with 2,800-cycle battery life and adjustable flow rates for delicate cell work.

- X3 Series X-Ray Solutions — End-of-line inspection for loose products (tablets, nuts, grains) with single and dual energy capabilities.

- Smart Automation Weighing Indicators — New high-speed data protocols for IT/OT ecosystem integration, partnered with leading MES providers.

Strategic Outlook

CEO Kaltenbach highlighted several growth drivers for 2026 and beyond:

-

Spinnaker Program — The company's proprietary sales and marketing methodology continues to drive market share gains

-

Automation & Digitalization — Increasing customer demand for automated lab solutions and connected instruments, with LabX software connecting broader product portfolios.

-

Onshoring Investments — Benefiting from manufacturing reshoring trends globally (though more a 2027+ catalyst)

-

Emerging Markets — Markets outside of China now represent 18% of sales and are growing above company average.

"Looking ahead, we are very well positioned to drive growth with our Spinnaker sales and marketing program and innovative product portfolio while capitalizing on opportunities related to automation, digitalization, and onshoring investments around the world." — Patrick Kaltenbach, CEO

Key Risks

-

Customer cautiousness to start 2026 — Management explicitly baked in cautious customer behavior for Q1, with organic volume expected down ~1.5%. "Just sitting here today, it feels like a prudent approach... things can change quickly in either direction."

-

Tariff exposure — Gross tariff costs were a 190bps headwind to Q4 operating margin and 130bps for FY2025. Guidance assumes current tariff levels remain in effect.

-

Chemical sector weakness — Specialty chemicals end market remains under pressure, particularly impacting core industrial and lab segments.

-

Academic/biotech funding — Pipette business saw slight decline in Q4 due to weak funding environment for academia and biotech. Recovery timing uncertain.

-

Valuation — At ~34x P/E and near 52-week highs, expectations are elevated for continued execution

Related Links: